List Of Deductible Business Expenses Pdf

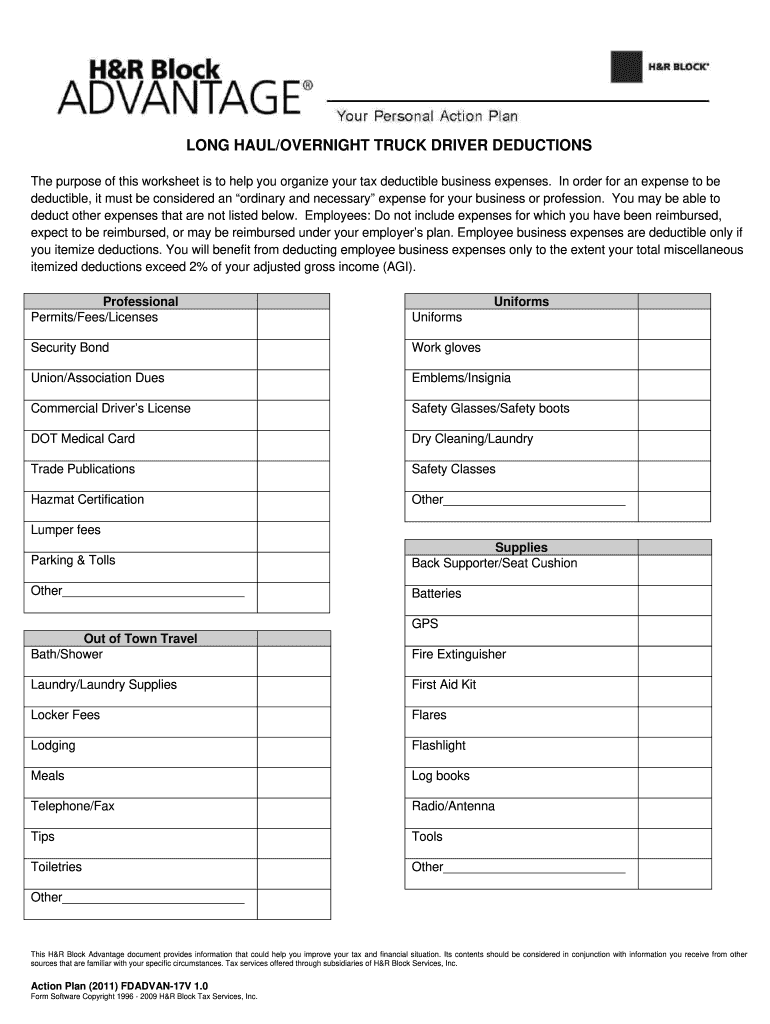

Examples include, education so long as it does not qualify you for the new trade or business, travel, meals and entertainment, mileage, telephone, etc. If they are ordinary , reasonable, and necessary for your business, they are deductible.

Here are the most common business expenses that are fully deductible against your business income:

List of deductible business expenses pdf. Advertising your tax deductible business expenses. The cost of taxis and other methods of transportation used on a business trip; Using your car while at a business location;

In such cases, you can deduct a portion of your: Remember, however, that you can only deduct the business use of the expense you’re deducting. Employee business expenses hobby expense to offset gains 50% of business related meals;

If you deduct actual expenses specify: Small businesses, freelancers and entrepreneurs can write off a range of business expenses when filing their income tax, including: Groceries, clothing, home repairs, pet food, etc.

Small business tax deductions worksheet 2020 neat education advertising and marketing computers and tech supplies cleaning and janitorial expenses moving expenses intangibles like licenses, trademarks, and other intellectual property business meals legal and professional fees These expenses can range from advertising to utilities and everything in between. Deductible expense will be any that is motivated by the business activity and which is aimed at perfecting the same, even when other, similarly objective, causes may com e into

Business expense list 2 b. And the businessman spends a lot of money on many things that shouldn’t be spilled among the individuals and the person engaged in some kind of business expenditure made on different segments. Fully deductible business expenses • accounting fees • advertising • bank charges • commissions and sales expenses • consultation expenses • continuing professional education • contract labor • credit and collection fees

List of deductible business expenses irs. • no personal expenses are deductible: Entertainment expenses are tax deductible.

Start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. But expenses for employee uniforms, employee housing repairs, etc. Office expenses, including rent, utilities, etc.

The irs allows you to deduct part of your transportation and vehicle costs, based on miles traveled during the tax year. Whereas business travel expenses, i.e., costs incurred during a business trip to another city or location are fully deductible, transportation costs—those costs incurred in the course of doing business daily—are different. Office supplies, including computers, software, etc.

The simple business expenses are done on the basis of the expenditure that the business person spends on the things important for the business or the things that are the unnecessary expenses of the people. Meals while travelling on business the cost of a meal while travelling on business is fully deductible as long as. Do not include expenses for cd, dvd blanks which you have been reimbursed, expect to be

Travel to and from your destination by plane, train, bus, or car; Likewise, if you use your car for business purposes, you can deduct the cost of driving those miles. Dryer for a massage therapist (business % if used for personal as well) • alarm system • camera & accessories • file cabinets

Commuting between your home and work is not deductible, but driving to meet clients or to get from one work site to another is deductible. Dry cleaning while on a business trip; List of deductible business expenses 2021.

• principal paid back on a loan is not deductible. In order for an books & magazines expense to be deductible, it must be considered an business cards ordinary and necessary expense. You may have expenses, unique to your business, that are not on this list.

Deductible expenses are those that are seen as “ordinary and necessary” for conducting business. Fully deductible expenses the following lists entertainm ent expenses that are fully deductible: Costs you can deduct or capitalize.

Deductible, irs approved business travel expenses include: The interest paid on a business loan is deductible, but not the principal. List of deductible business expenses list of deductible business expenses pdf.

A list of common deductible business expenses follows. You may include bank charges other applicable expenses. What can be written off as business expenses?

Komentar

Posting Komentar